A Legacy of Excellence Under Scrutiny

For nearly four centuries, Harvard University has stood as a beacon of academic excellence, innovation, and global impact. As the oldest and one of the most endowed universities in the United States, Harvard has educated leaders, driven groundbreaking research, and advanced societal progress. Its tax-exempt status, granted under Section 501(c)(3) of the U.S. tax code, recognizes its role as a charitable and educational institution dedicated to the public good. However, in April 2025, this status came under unprecedented scrutiny as the Internal Revenue Service (IRS), reportedly influenced by the Trump administration, moved to consider revoking Harvard’s tax exemption.

This development, first reported by CNN on April 17, 2025, marks a historic clash between a sitting administration and one of America’s most iconic institutions. The potential loss of tax-exempt status could impose an estimated $465 million annual tax bill, according to Bloomberg News, threatening Harvard’s ability to fund scholarships, research, and community programs. As the university navigates this challenge, it remains steadfast in its commitment to its mission, its stakeholders, and the principles of academic freedom.

The Context: A Policy Dispute Escalates

The IRS’s consideration of revoking Harvard’s tax-exempt status follows the university’s refusal to comply with a series of policy demands from the Trump administration. These demands, which included changes to hiring, admissions, and curriculum policies, were met with resistance from Harvard’s leadership, who cited First Amendment protections and the university’s autonomy. In response, the White House froze $2.2 billion in multi-year grants and $60 million in contracts, as reported by ABC News, and President Trump publicly questioned Harvard’s tax-exempt status on Truth Social, stating, “Perhaps Harvard should lose its Tax Exempt Status and be Taxed as a Political Entity if it keeps pushing political, ideological, and terrorist inspired/supporting ‘Sickness?’”

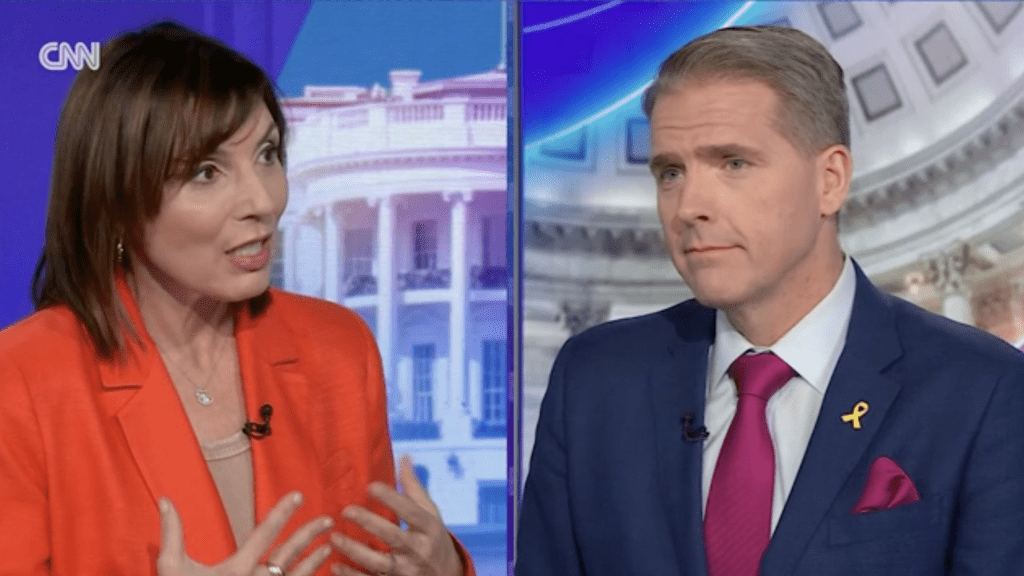

The administration’s actions reflect a broader critique of elite universities, with Trump and his allies arguing that institutions like Harvard, with its $53 billion endowment, should not receive taxpayer subsidies if they fail to align with certain public interests. Education Secretary Linda McMahon echoed this sentiment, telling CNN’s “The Arena” that the issue is “worth looking into,” particularly for “elitist schools” with large endowments. The administration has also pointed to allegations of antisemitism and campus unrest as justification, referencing the 1983 Supreme Court ruling in Bob Jones University v. United States, which upheld the IRS’s authority to revoke tax-exempt status for institutions violating public policy.

Harvard’s Response: Defending Its Mission

Harvard University has responded with clarity and resolve, asserting that there is “no legal basis” for revoking its tax-exempt status. In a statement reported by the Boston Herald, the university emphasized that such an action would be “unprecedented” and would jeopardize its ability to carry out its educational mission. Harvard President Alan M. Garber, in a letter to the administration, argued that the demands violate the university’s First Amendment rights and exceed the government’s statutory authority. “No government—regardless of which party is in power—should dictate what private universities can teach, whom they can admit and hire, and which areas of study and inquiry they can pursue,” Garber wrote.

Former Harvard President Larry Summers, who served as Treasury Secretary under President Bill Clinton, condemned the move as a “weaponization of the IRS against a political adversary of the President.” Legal experts, including Samuel Brunson, cited by CBS News, agree, noting that a 1998 federal law prohibits the president from directing IRS audits or investigations. “There is absolutely no basis for Harvard to lose its exemption. Zero,” Brunson stated. Harvard has signaled its readiness to challenge any revocation through the IRS’s appellate process and, if necessary, in U.S. Tax Court.

The Stakes: Financial and Beyond

The financial implications of losing tax-exempt status are staggering. Harvard’s tax-exempt status saves the university hundreds of millions annually in federal income and property taxes, funds that support $489 million in direct research funding, $1 billion in sponsored research, and extensive financial aid programs. In fiscal year 2023, 27% of Harvard’s students were international, contributing to globally prominent research, as noted by The New Indian Express. Revoking this status could also deter donors, whose contributions are tax-deductible, further straining the university’s resources.

Beyond finances, the move threatens Harvard’s ability to attract top talent, fund cutting-edge medical research, and maintain its role as a global leader in education. The U.S. Department of Homeland Security’s simultaneous threat to block Harvard’s ability to enroll foreign students, reported by CBC News, compounds these challenges, potentially disrupting the university’s diverse academic community. Protesters on Harvard’s campus, as covered by WCVB, expressed fears that this precedent could extend to other universities and even religious institutions, eroding the independence of nonprofit organizations.

A Broader Context: The Future of Higher Education

The clash between Harvard and the Trump administration is not an isolated incident but part of a larger debate about the role of elite universities in American society. Critics, including the administration, argue that institutions like Harvard, with their vast endowments, should face greater scrutiny over how they serve the public interest. Republicans have previously targeted Ivy League endowments, imposing a 1.4% tax in 2017, and may expand this levy, as reported by POLITICO. Trump’s comments on April 18, 2025, suggesting that Columbia and Princeton could also face IRS scrutiny, signal a potential broadening of this campaign.

However, Harvard and its supporters argue that tax-exempt status is not a “privilege” but a recognition of the public good provided by education and research. The university’s contributions—ranging from medical breakthroughs to economic innovation—benefit not only its students but society at large. Revoking its status could set a dangerous precedent, allowing future administrations to target organizations based on ideological differences, as warned by Utah Governor Spencer Cox in the Deseret News.